Builders scramble to adapt to changing consumer trends & overcome COVID delays, but Denver home building activity remains below last year’s.

Consumer trends are changing, and home purchases are coming in at a frenetic pace. In this article by Housing Tides, HBA of Metro Denver compares 2019 & 2020 permit data, emphasizing 2020’s slower pace which is leading home builders to adapt quickly in order to overcome year-end challenges.

2020’s Rough Start: Home Builder Production Set Back by Over Two Months

When the COVID-19 pandemic hit in March of this year, the Denver Metro Area’s home building industry was stunned. Builder sales offices were open on a very limited basis. Uncertainty gripped the marketplace. Builders paused production. How could operations be made safe on construction sites? Will the buyers return in the lowest mortgage interest rate environment in over 60 years? The market recovery that was to follow by May was truly remarkable.

Construction labor was considered essential. COVID-19 safety measures were quickly put into place by Denver’s creative and resilient home builders. Home buying came back with more strength than the year before. Builders lost over two months in production time due to the pandemic and needed to catch up with the home purchases – coming in at a frenetic pace.

Permits for Denver Home Building Activity Closely Monitored by the HBA

The Home Builders Association of Metro Denver (HBA) has long monitored building permit activity in the eight-county metro area in detail and with accuracy.

Each month, every permit-issuing jurisdiction sends in the permit application information to the HBA. The information is then formatted to give an accurate picture of who is building and where. The data chronicles the year-over-year comparisons in permit activity. This is the earliest predictor of the economic impact of the housing market.

Housing Permits Have Not Kept Up With 2019 Pace

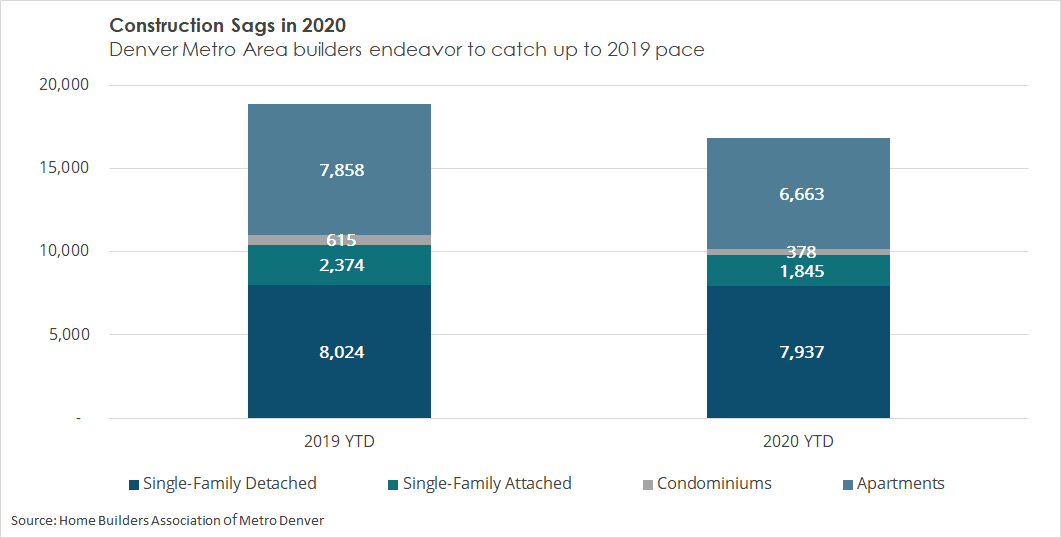

The HBA reports that through October 2020 permit activity in total lagged 2019 by 10.9% (from 18,871 units to 16,823). Breaking this down further, the apartment builders’ activity dropped by 15.2% (from 7,858 units to 6,663).

The HBA reports that through October 2020 permit activity in total lagged 2019 by 10.9% (from 18,871 units to 16,823). Breaking this down further, the apartment builders’ activity dropped by 15.2% (from 7,858 units to 6,663).

Merchant home builders’ activity through October 2020 lagged 2019 by 7.7%. Condominium activity saw the biggest decline, dropping 38.5% (from 615 to 378). This was followed by townhomes and duplexes with a 22.3% drop (from 2,374 to 1,845). Only single-family detached homes stayed near the 2019 levels with only a 1.1% drop (from 8,024 to 7,937).

Denver Home Buyers Flee to The Suburbs

Much has been written about the flight to the suburbs this year with Millennials seeking bigger homes away from the crowded urban core. The numbers for Denver bear this observation out with a 25.6% decline for condominium and townhome permits.

Production Home Builder Activity Declines and Shifts to Suburbs

There are approximately 30 home builders in the Denver metro area that operate on a large-scale production basis. This class of home builders, headed by Lennar and Richmond American, is scrambling to keep up with 2019. This group’s activity was down 1,198 units ( -17%) through October (from 7,208 to 6,010). Production home builders are focused on process and have quickly shifted the product offerings to the hot single-family market in the suburbs.

Denver Custom Home Building Drops by 37%

Last year there were 44 HBA builders pulling permits for custom homes. It appears that the pandemic has taken its toll on the builders in this market. In 2020 the number of builders pulling permits for custom homes dropped to 30.

Permit counts for custom homes saw a 37% decline in 2020 from 2019. In 2020, 81 permits were issued as compared to 128 in 2019.

The process for building a custom home is more complex and more prolonged than ordering a new production home. This aspect accounts for the fact that custom home building is slower in the recovery.

In Conclusion: 2020 Conditions Require Home Builders to Adapt Quickly

- Production setbacks hindered the homebuilders’ timing in the Denver Metro area by at least two months or almost a full quarter of the year. New sales and production methods were created to deal with the viral nature of COVID-19.

- The Denver HBA provides a valuable service monitoring permit activity.

- Buyer preference shifted to single-family detached homes in the suburbs, away from condominiums and town homes in urban areas.

- Home builders are scrambling to catch up from pandemic. It will be a big year ahead for building in the suburbs.

- Custom home building saw a big drop in the number of active builders and unit activity. Next year, 2021, should provide a strong recovery for this market.

- The delays’ economic impact was enormous in 2020—many lost jobs in the trades and with the suppliers. However, the recovery will be strong in the next year. Employment will strengthen as interest rates stay low.

- Jurisdictions that limit growth will be subject to renewed political pressure to increase the housing supply.

Interested in buying or selling a home in Denver?